In the model demonstrated here asset allocation is brought to 6040 five years before retirement. Check out our article on asset allocation at Carmignac Patrimoine.

Miable 60 40 Balanced Portfolio Miable

I demonstrate two different returns.

60 40 asset allocation. You need to do this because for instance if stocks have a good year and bonds have a bad one equities could end up representing a far bigger percentage of your portfolio than 60. Heres how it works and who its right for. Vanguard Group defended the strategy in a recent note to its clients saying the asset allocation allows investors and their portfolios to combat volatility such as during the current global.

In practical terms it involves selling some outperforming assets and re-investing the proceeds in the underperforming ones so that the mix of stocks and bonds remains 6040. Popularized by Jack Bogle the founder of Vanguard who pioneered index investing the Classic 60-40 portfolio has long been a staple of passive investors. Die sogenannte Asset Allocation die Aufteilung des Vermögens zwischen sicheren und riskanten Anlagen bestimmt bei passiven Portfolios die künftige Rendite und das Risiko.

Finally it shows that 6040 is the optimal asset allocation but that the curve is pretty flat between 50-80 equities. ETF allocation and returns. The turbulence in the markets over the past few decades has led a growing number of.

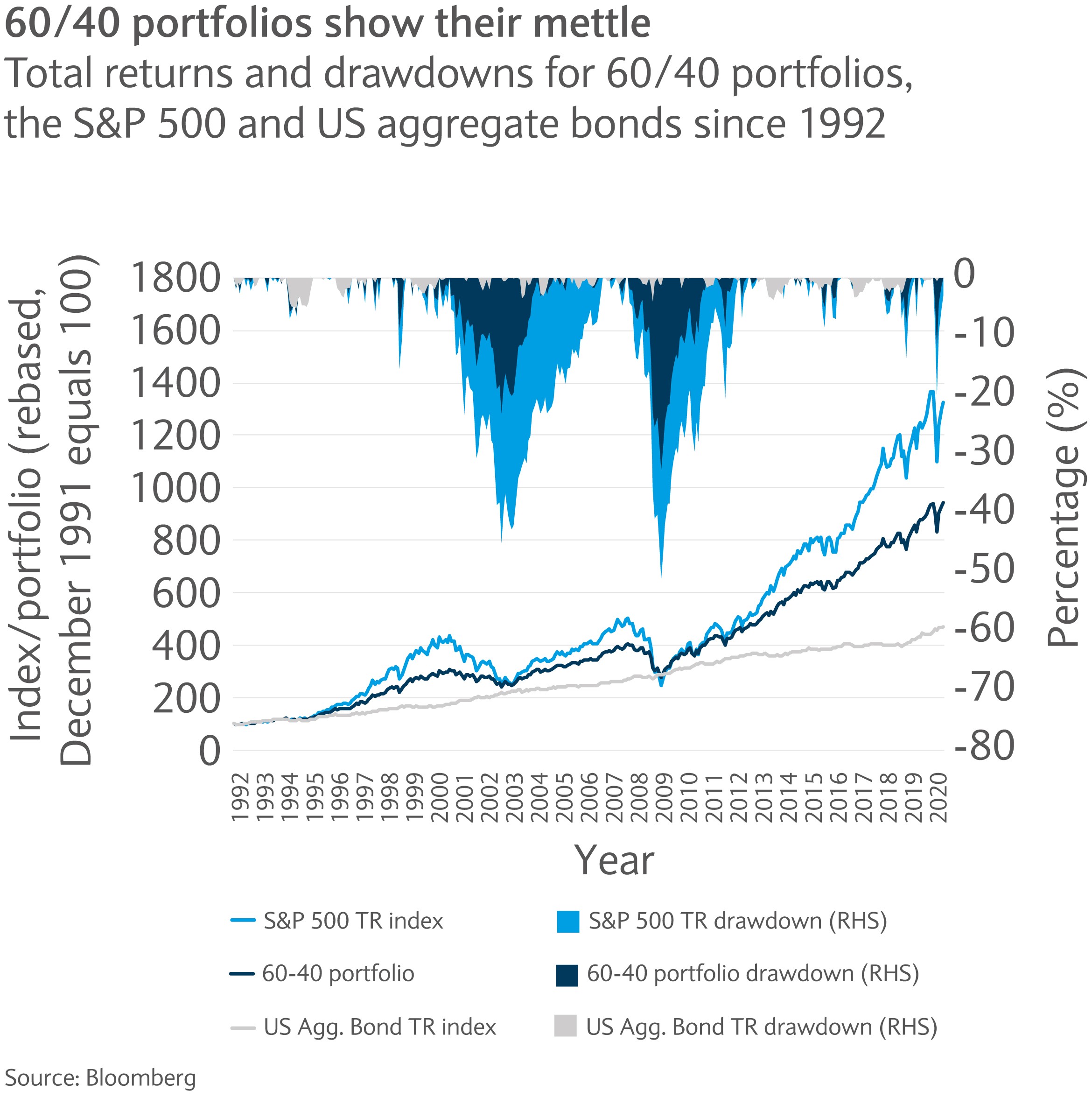

The 6040 mix of stocks and bonds have yielded superior returns in some markets but has some limitations as well. The 60-40 Stock-Bond Asset Mix Is Dead BofA Warns. A 6040 mix of stocks and bonds is a classic asset allocation but does it make sense for your portfolio.

What is an allocator. Anzeige Credit Suisse Invest finden Sie jetzt die Anlagelösung die zu Ihnen passt. Anzeige Actively managing your savings for the long term is our business.

In this range the maximum safe withdrawal is about 4000 which is 4 of. The Coronavirus Chain Reaction on Asset Allocation Modern Society and Portfolio Performance. Anzeige Actively managing your savings for the long term is our business.

His seminal article laid out arguments for why 60 stocks and 40 bonds is the ideal asset allocation for long-term investors. Die richtige Mischung zu finden ist besonders für unerfahrene Anleger nicht trivial. This example illustrates that.

A quick note about future expected returns. CIO Roundtable Part 3. It is held there until retirement and then increases incrementally to 9010 over either 10 Glide10 or 20 Glide20 years after retirement.

Check out our article on asset allocation at Carmignac Patrimoine. Peter Bernstein wrote The 6040 Solution in 2002. Other versions vary percentages by age and slice and dice the assets.

The Classic 60-40 portfolio is the ubiquitous asset allocation that serves as the benchmark in most portfolio discussions. Anzeige Credit Suisse Invest finden Sie jetzt die Anlagelösung die zu Ihnen passt. Goldman Sachs GS GOAL research team puts the projected 10-year return of a 6040 portfolio at something closer to zero especially after inflation.

In this case their retirement income allocation is 1981 which is still much lower than their 6040 asset allocation. 37 Zeilen StocksBonds 6040 Portfolio. 60-40 asset allocation Bank of America Bloomberg Barclays US Aggregate bonds Federal Reserve SP 500 Stocks Vanguard Investments.