Private equity investing requires lots of capital and expertise but investors can learn how to evaluate PE firms and how to access them. Why can you make so much money in private equity as an investor.

Private Equity Firms And Developers Together Again With A Twist The Real Deal

They can invest in a startup or private company as a member of the friends and family group.

Can you invest in private equity firms. Creating competition usually leads to a higher price and a better agreement. The members of the private equity firm can and cannot invest. Some are strict financiers or passive investors wholly dependent on management to grow.

Anyway you must be. So even average investors can access private equity. They try to sell the companies at a much higher price than what they paid for them.

This question is important for you as it will determine the amount of travel you can expect from. Private equity investments arent subject to the same level of disclosure requirements as. High net worth individuals venture capitalists and seasoned investors are major sources for firms to raise funds which can.

Most private equity firms typically look for investors who are willing to commit as much as 25 million. Firms can keep the holdings or sell these stakes to private investors institutional investors government and pension funds and hedge funds. Private equity firms reputation for dramatically increasing the value of their investments has helped fuel this growth.

But this doesnt eliminate the risks associated with private equity investments which. Second and more importantly GPs have their own comfort zone which is often a subset of the theoretically authorised area. There usually is a very high minimum to invest.

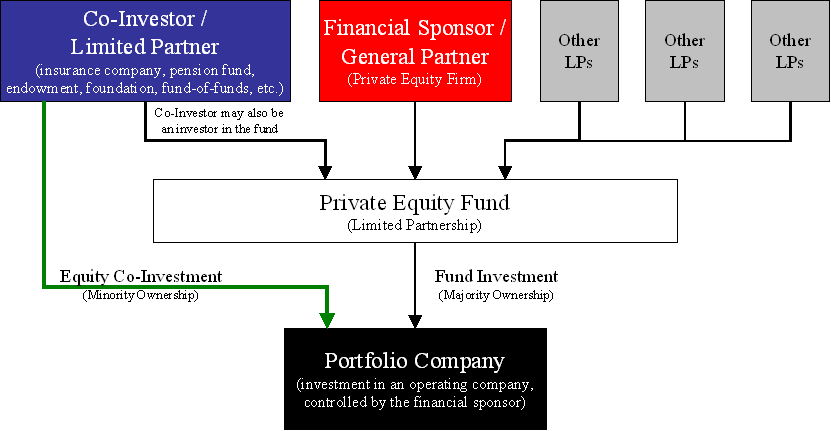

The private equity firm would put your money in a private equity fund along with money from other investors and invest the pool of money in various. They can also buy stock in a publicly trading private capital firm or buy an exchange-traded fund that invests in private capital firms. To invest in companies private equity firms need funds.

They typically are made by private-equity firms that pool the resources of wealthy and well-connected individuals and institutions. Private equity firms can either be privately held or a public company listed on a stock exchange. Private-equity PE firms have a range of investment preferences.

By contrast private equity firms make money by exiting their investments. We dont recommend negotiating with only one private equity firm as it gives them an advantage in negotiating opportunities. Large pension funds such as the California Public.

If the company is very attractive and there are competitors trying to invest in it private equity firms will be more willing to invest greater amounts and receive lower returns. Save up to 76 You may already be benefiting -- albeit indirectly -- from private equitys high returns. Lets look at both sides of the transaction.

Their ability to achieve high returns is typically attributed to a number. Private equity is a high-risk long-term investment that has traditionally been reserved for affluent and experienced investors. The SEC wants only qualified investors to be able to invest in private equity.

Investment bankers make money by advising companies structuring sales raising capital and taking a percentage fee on each transaction. Private Equity Firms These private stakes in a company are usually bought by private equity firms. Private equity investing is not easily accessible for the average investor.

First investors sign a term sheet which formally defines the areas where the General Partners or GPs ie. But today you can indirectly access private equity through ETFs stocks of publicly listed private equity firms and other assets. Be a smarter better informed investor.

An initial public offering IPO shares of the company are offered to the public typically providing a partial immediate realization to the financial sponsor as well as a public market into which it can later sell additional shares. Private-equity firms generally receive a return on their investments through one of the following avenues. Smaller investors have three ways to participate in private equity.