Rates terms and fees as of 5052021 1016 AM Eastern Daylight Time and subject to change without notice. Wells Fargo WFC which is trading close to its 52-week high with 294 gain in the January-March period might rally further post first-quarter.

Wells Fargo Mortgage Rates Mortgage Blog

24-Month Interest Only Lot Loan 5.

Wfc mortgage rates. 5138 150 Home Equity Line of Credit HELOC 8. 25 minimum opening deposit. Our people make the difference in how we serve our Customers Community and each other.

3 Min Read. It has over 8600 retail locations through the United States and internationally. Skip to main content.

A difference of just 03 can save you between 60-100 on average in your monthly mortgage payment. Your rate fees and terms may differ based on when your rate is locked actual occupancy status loan purpose loan amount credit score debt to income ratio loan to value ratio etc. Refinancing an existing mortgage.

It operates in three segments. Mortgage Loan Program Interest Rate Interest Only Payments APR Fee. Fixed First And Second Mortgage Rates.

Northwest Federal Credit Union Online Mortgage Center - Rate Search Criteria. The payment examples do not include mortgage insurance. Time Account CD rates.

Look up current rates on a variety of products offered through Wells Fargo. Were happy to assist you. Select a product to view important disclosures payments assumptions and APR information.

Learn more about us then contact your local WSFS Mortgage Loan Officer to get started. Available on primary residence properties single-family townhome condominium on loan amounts up to 548250. Its the seventh consecutive week in.

Wells Fargo holds over 19 trillion in assets and has over 200000. 3 Down 1 - This option is available for first-time as well as repeat home buyers purchasing a primary residence single family townhome or condominium. The actual payment will be higher if mortgage insurance is required on your loan.

The payment examples do not include amounts. 7167 150 24-Month Interest Only Lot Loan 7. Credit and debit cards.

We make it easy to get the loan that fits your goals and your budget. The average interest rate on a 30-year fixed-rate mortgage since 1971 is 861. WFC is one of the largest financial institutions in the United States offering bank insurance investment mortgage and diversified lending operations to institutions and individuals.

Thats a savings of up to 3600-6000 over a 5-year term. Community Banking Wholesale Banking and Wealth and Investment Management. Comparing mortgage rates between different providers is the best way to get the lowest rate you can qualify for.

At the end of. At the end of last week it was 437 or roughly half the long-run average. The Community Banking segment offers checking and savings accounts.

Reuters - Wells Fargo Co WFCN is boosting its teams that process mortgage loans to prepare for higher mortgage volumes changing course after it laid off about 1000 employees. Check back periodically as we regularly add new rates pages. The 30-year fixed-rate mortgage averaged 318 for the week ending April 1 up one basis point from the previous week Freddie Mac FMCC reported Thursday.

Wells Fargo Company NYSE. Or simply interested in drawing upon your homes equity. At Yahoo Finance you get free stock quotes up-to-date news portfolio management resources international market data social interaction and mortgage rates.

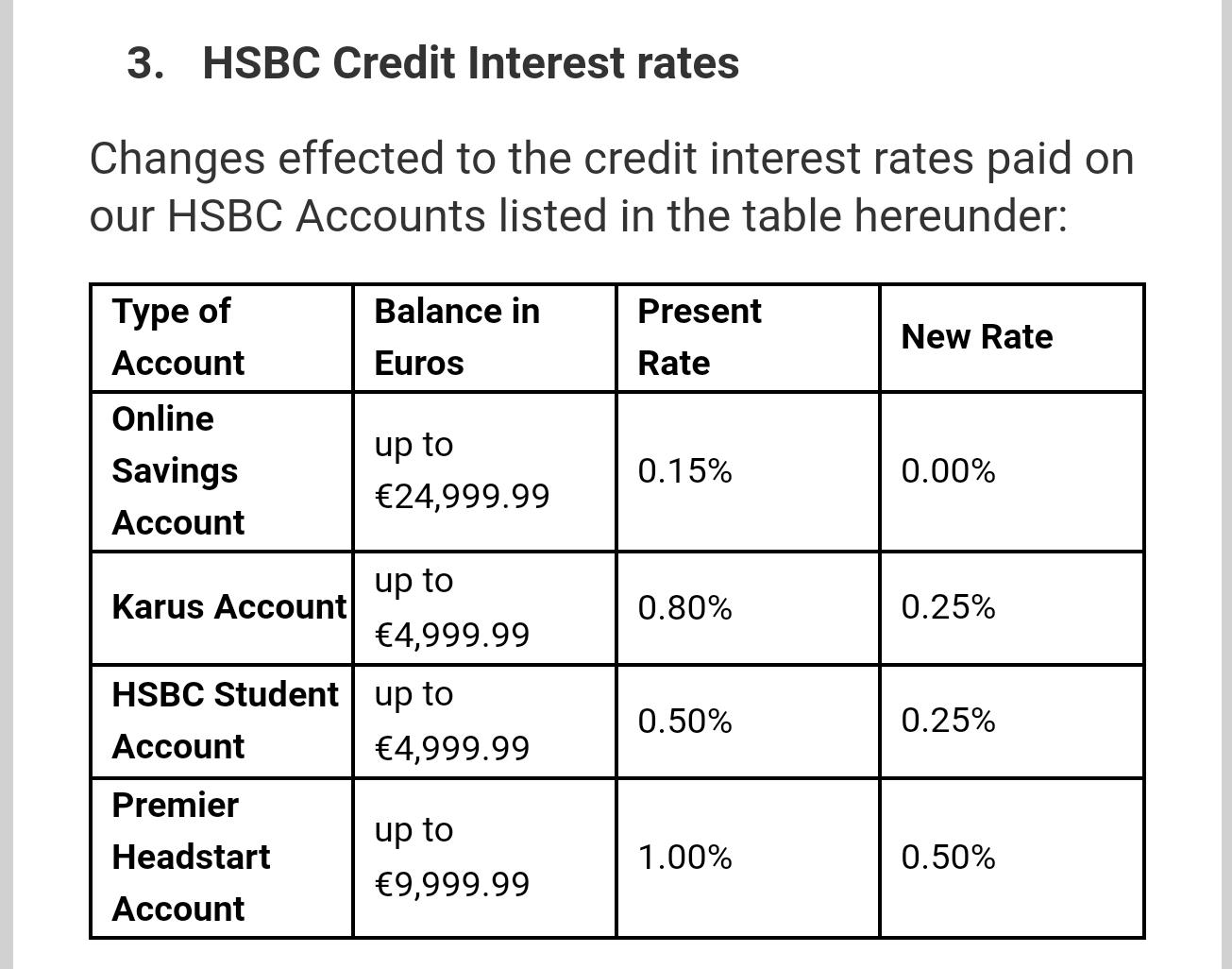

Interest Rates and Annual Percentage Yields APY table. Provider of banking mortgage investing credit card and personal small business and commercial financial services. Whether youre a first-time or repeat homebuyer.

Your WSFS Mortgages team is made up of experienced industry leaders who offer a hands-on communicative and cooperative approach. Compare home mortgage rates and loans using the Wells Fargo Customized Mortgage Rate Tool. And automobile student mortgage.

Open a Way2Save Savings account. Wells Fargo Company a diversified financial services company provides banking investment mortgage and consumer and commercial finance products and services to individuals businesses and institutions in the United States and internationally.