SP 500 Equal Weighted TR USD 1553 1653 5705 3917 1772 474. The Fund seeks to replicate before fees and expenses the total return of the SP 500 Equal Weight Index.

Index Funds S P 500 Equal Weight No Load Shares

The index is designed to measure the performance of 500 US.

Index funds s&p 500 equal weight no load. Index Funds SP 500 Equal Weight No Load Shares INDEX Nasdaq - Nasdaq Delayed Price. Find our live Index Funds Sp 500 Equal Weight No Load Shares fund basic information. View the latest Index Funds SNo Load INDEX stock price news historical charts analyst ratings and financial information from WSJ.

Large Blend 1587 1671 4651 2935 1283 478. The fund will invest under normal. Index Funds - Index Funds SP 500 Equal Weight is an open-end equity indexed mutual fund launched and managed by OneFund LLC.

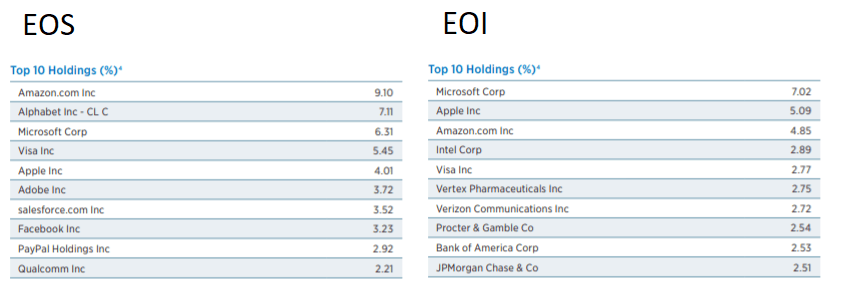

Is the SPDR SP 500 ETF NYSEARCA. Index Funds SP 500 Equal Weight No Load SharesINDEX Top Ten Holdings as of 03312021 Top 10 Holdings in INDEX 228086 Category Average 4941 Top 10 holdings are 228086 of the total portfolio assets. Get quote details and summary for Index Funds SNo Load INDEX.

Information on users sentiments for the Index Funds Sp 500 Equal Weight No Load Shares fund which are displayed both on charts of different periods of time and on a detailed table. Dow Jones a News Corp companyAbout WSJ. 4518 066 148 At close.

The fund invests in public equity markets of the United States. Index Funds SP 500 Equal Weight NoLoad INDEX Morningstar Analyst Rating Quantitative rating as of Mar 31 2021. Its market-cap-weighted with the same holdings as the SP.

SPY with 2838 billion in total assets. The investment seeks to replicate before fees and expenses the total return of the SP 500 Equal Weight Index. Index Funds SP 500 Equal Weight No Load Shares No Load INDEX company overview trading data share statistics valuation profitability financial snapshot.

View analyze the INDEX fund chart by total assets risk. Index Funds SP 500 Equal Weight NoLoad INDEX 3729 -043 -114 USD Nov 30 Quote. The largest exchange-traded index fund listed in the US.

The fund will invest under normal circumstances at least 80 of its net assets and borrowings for investmen t purposes in securities of issuers included in the index. The category average percent of Portfolio in top 10 holdings is 4941 Symbol Company Name Industry Percent of Assets. The investment seeks to replicate before fees and expenses the total return of the SP 500 Equal Weight Index.

189 рядків Index Funds SP 500 Equal Weight No Load Shares. The Fund seeks to achieve its investment objective by investing in a portfolio of assets. Research current and historical price charts top holdings management and full profile.

Index Funds SP 500 Equal Weight NoLoad. Adjusted Expense Ratio excludes certain variable investment-related expenses such as interest. Index Funds SP 500 Equal Weight NoLoad INDEX.

Index Funds SP 500 Equal Weight No Load Shares 1529 1627 5619 3872 1753 470. May 14 800PM EDT.

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png)