GUGG Health Care 28 CA. This process has earned good results during Hynes 675-year tenure at the helm and this fund is still an attractive option for investors who are seeking a geographically diverse healthcare.

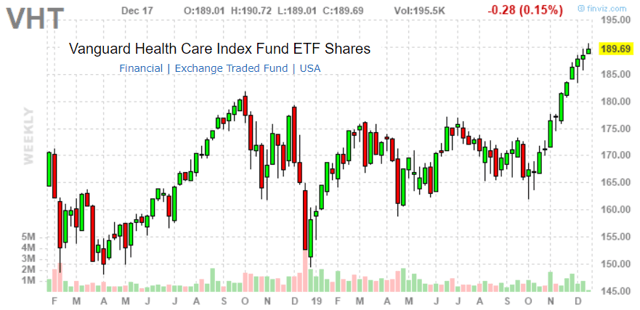

Vanguard Health Care Index Fund Etf Shares Vht Traders Paradise

Vanguard Health Care Index Fund Etf Shares Vht Traders Paradise

Vanguard Health Care Index Fund Admiral Shares.

Vanguard healthcare index fund. This includes pharmaceutical companies HMOs and. The investment seeks to track the performance of a benchmark index. These results lagged the 1774 return of the benchmark the MSCI All Country World Health Care Index.

2021 Investor Shares of Vanguard Health Care Fund returned 1616 and Admiral Shares returned 1621. Vanguard Health Care Index Fund ETF Shares VHT. The Vanguard Health Care Fund falls within Morningstars health category.

The Vanguard Health Care Index Fund tracks the MSCI US Investable Market Health Care 2550 Index and offers broad exposure to the health care sector. Equity market which includes stocks of companies involved in providing medical or health care products services technology or equipment. Vanguard Health Care Fund Admiral Shares VGHAX Also available as Investor Shares mutual fund.

Vanguard Health Care ETF Learn about the Vanguard Health Care ETF its holdings and how it may be appropriate for a growth-oriented investor who wants to invest in the sector. The funds main risk is its narrow scopeit invests solely in health care stocks. To 8 pm Eastern time.

If youre already a Vanguard client. The Process Pillar is our assessment of how sensible clearly defined and repeatable VHCIXs performance objective and investment process is for both security. The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index IMIHealth Care 2550 an index made up of stocks of large mid-size and small US.

VANGUARD HEALTH CARE ETF. VANGUARD GLOBAL BOND INDEX FUND FONDS Fonds WKN A0NE59 ISIN IE00B18GC888 Aktuelle Kursdaten Nachrichten Charts und Performance. VANGUARD HEALTH CARE ETF SHAR.

SPDR SP Biotech ETF. This fund is geared toward investors who are. The Fund seeks to track the performance of a benchmark index that measures the investment return of health care stocks.

Choose your Vanguard ETFs. We combine biotechnology and pharmaceuticals and. The investment environment We view the health care sector through a custom lens of subsectors.

GUGG Health Care 28 F CA. Vanguard Health Care Index Fund ETF. Aktueller VHT ETF Kurs Charts technische Analysen historische Daten Volumen Marktkapialisierung Fondsvermögen News.

Enjoy the Vanguard ETF advantage. Alles zum Fonds Realtime-Kurs Chart Nachrichten Chartanalysen und vieles mehr. Funds in this category invest in stocks in the health and medical fields.

About Vanguard Health Care Index Fund Vanguard Health Care Index Fund seeks the performance of a benchmark index that measures the investment return of health care stocks. This low-cost index fund offers exposure to the health care sector of the US. Companies within the health care sector as classified.

Investable Market Health Care Index. Specifically the MSCI US. John Hancock Multifactor Health Care ETF.

An investor should expect high volatility from the fund which should be considered only. Vanguard Health Care Index Fund ETF Shares ETF. Buy a Vanguard ETF.

/investing-in-index-funds-for-beginners-0f50f5cc29f84124b1a16c799b70df46.png)