We Need Your Support. The average 30-year fixed mortgage rate is 420 down 7 basis points from 427 a week ago.

Mortgage Rates Fall To 50 Year Low

Mortgage Rates Fall To 50 Year Low

The average for the month 216.

15 year mortgage rate trend chart. Rates displayed are AmeriSaves historical 30 year fixed 15 year fixed and 7 year adjustable rates. Consumer income and spending are picking up which is leading to an acceleration in economic growth. FHA 30 Year Fixed.

If youre looking. The high annual rate was attained in November 2018. Backlinks from other sites are the lifeblood of our site and our primary source of new traffic.

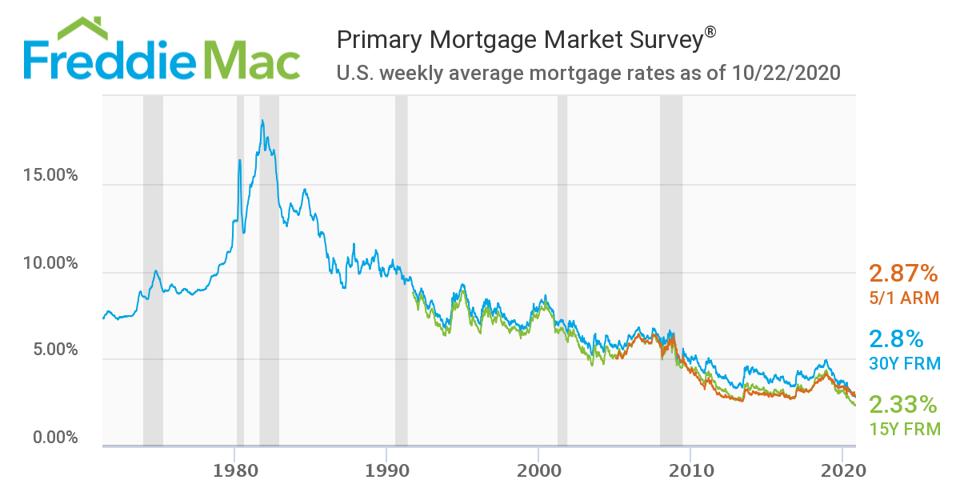

The above table lists the monthly average rates for conventional and conforming 15- and 30-year fixed-rate mortgages in the United States. Historically the 15-year mortgage rate reached upwards of 889 in 1994 and has made historic lows in 2020. 30 Year Fixed Mortgage Rate - Historical Chart.

Mortgage rates have remained under three percent for three consecutive weeks. 15 Year Mortgage Rate forecast for September 2021. Indicator that the long term rate trend in 15 Year Mortgage Rates is up.

15- and 30-Year Fixed-Rate Mortgages In The USA. The market low was achieved in February 2019. Its also good for homeowners who may have missed prior opportunities to refinance and increase.

Mortgage rates had enjoyed a solid little run for almost all of April and. Prime Rate vs 15 30 Year Fixed-Rate Mortgages vs 10-Year Treasury Yield. Historically the 30-year mortgage rate reached upwards of 186 in 1981 and went as low as 33 in 2012.

The 15 Year Mortgage Rate forecast at the end of the month 213. Graph and download economic data for 15-Year Fixed Rate Mortgage Average in the United States MORTGAGE15US from 1991-08-30 to 2021-05-13 about 15-year mortgage fixed interest rate interest rate and USA. Mortgage rates chart graphs data available by month from 1986 to 2016.

Mortgage experts mostly think rates are due to rise in the week ahead May 13-19. 15-year fixed-rate mortgage 230. 53 rows 30 Years.

The combination of low and stable rates coupled with an improving economy is good for homebuyers. This is lower than the long term average of 528. Check Zillow for mortgage rate trends and up-to-the-minute mortgage rates for your state or use the mortgage calculator to calculate monthly payments at the current rates.

There are many different kinds of mortgages that homeowners can decide on which will have varying interest rates and monthly payments. Use the mortgage rate chart tools below to view AmeriSave historical 30-year fixed 15-year fixed and 7-year adjustable mortgage rate trends. The highest annual rate over the last 12 months was 428.

A 15-year fixed-rate mortgage. 15 Year Mortgage Rate is at 229 compared to 235 last week and 280 last year. Monthly Average Commitment Rate And Points On 15-Year Fixed-Rate Mortgages.

The 15 Year Mortgage Rate forecast at the end of the month 209. Additionally the 15-year fixed mortgage rate was 209 and for 51 ARMs the rate was 238. 12 rows The average 15-year jumbo mortgage rate is 2350 with an APR of 2420.

The current 30 year mortgage fixed rate as of April 2021 is 298. 30 Year Mortgage Rate is at 298 compared to 297 last week and 333 last year. The lowest was 380.

In response to Bankrates weekly poll 57 percent said rates will go up 29 percent said rates would stay the. 51-year adjustable-rate mortgage 270. Mortgage Interest Rate forecast for August 2021.

Primary Mortgage Market Survey. Maximum interest rate 215 minimum 203. Search local rates in your area and learn which factors determine your mortgage interest rate.

The average for the month 210. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since 1971. Rates shown do not include additional feescosts of.

- Current Mortgage Rates - 30 Year Fixed Rate Mortgage. Information on points can be found at the Freddie Mac website. At a 3 interest rate for a 200000 home loan youd pay 103000 in interest charges with a 30-year mortgage paid off on schedule.

15-year fixed mortgage rates fell 5 basis points to 355 from 360 a week ago.