If you go solar in 2023 you will be eligible for a 22 tax credit. The President has passed the federal spending package and all solar aspects are still intact.

The Extended 26 Solar Tax Credit Critical Factors To Know

For example if you pay 14000 for a solar panel.

Solar tax credit extension. That package included a two-year extension of the federal solar investment tax credit. Schumers office the two-year extension of the federal Investment Tax Credit for. Solar made it into the American Jobs Plan in the form of a proposed 10-year extension and phase down of an expanded direct-pay investment tax credit and production tax credit for clean energy generation and storage.

This extension means you could earn several hundred dollars more in tax credits. The Relief Bill among other things extends renewable energy tax credits for wind projects solar projects and carbon. Congress extended the investment tax credit used for residential and commercial solar projects at its current rate of 26 for two years in.

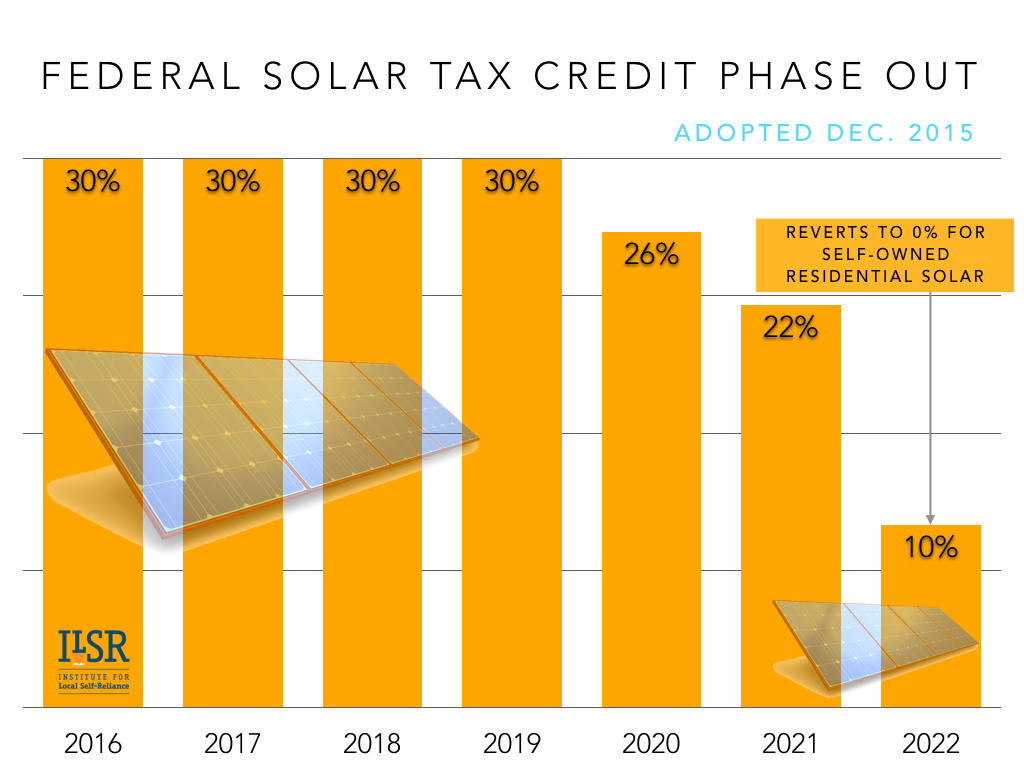

They were later extended to 2020 where they were to begin a gradual drop-down to 0 for residential installs and 10 for commercial installs by 2022. Solar and Wind Tax Credits Extended Again. Federal solar tax credit based on the full cost of the system.

The tax credit is only for systems that. On Monday December 21 2020 the United States Congress passed a second large stimulus bill 1 the Relief Bill aimed at curtailing the economic disruptions caused by COVID-19. The federal ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007.

Congress has extended the current rooftop solar tax credit incentive of 26 which was about to expire at the end of 2020 for two years. This package will bring huge relief to Americans who are struggling in the. US President Joe Biden has included a 10-year extension for the Investment Tax Credit for both clean power generation and energy storage as part of a US2 trillion infrastructure investment plan to.

The plan would also use the federal governments purchasing power to secure 247 clean power for federal buildings. Solar investment tax credit extended at 26 for two additional years By Kelly Pickerel December 21 2020 Dec. Thanks to the recent extension the tax credit will now stay at 26 for two more years.

A series of extensions pushed the expiration date back to the end of 2016 but experts believed that an additional five-year extension would bring the solar industry to its full. Perhaps the most important provision included in the Moving Forward Act is the extension of the federal solar tax credit also known as the investment tax credit ITC. Up to 2019 these credits constituted a 30 deduction on the cost of purchasing solar from the buyers taxes and were set to expire in 2016.

Solar tax credit impacts According to a summary shared by Sen. The federal tax credit has been a major player in the growth of the solar industry allowing solar to have an impressive average annual growth rate of 49. What does the federal solar tax credit extension mean for the solar industry.

If you buy a solar system in 2021 or 2022 you will still be able to take the tax credit at 26. The credit expires after 2023. Solar Tax Credit The two-year extension of the federal Investment Tax Credit ITC for solar projects will retain the current 26 percent credit for projects that begin construction through the end of 2022 rather than expiring at the end of 2020.

The Consolidated Appropriations Act 2021 extended the 26 tax credit through 2022. The two-year solar tax credit extension will facilitate more demand for residential and commercial solar systems in our state which will in turn help to keep solar installers employed and. If passed the Moving Forward Act would.

We are thrilled to announce the Extension of the 26 Solar Investment Tax Credit. The solar tax incentive extension was included in a 14. Miscellaneous expenses including interest owed on financing origination fees and extended warranty expenses are not eligible expenses when calculating your tax creditI bought solar panels but have not installed them yet.

The United States federal spending and tax extension package was passed by congress alongside the 900 Billion Covid Relief package last week and signed into law by the President on Sunday night. It will drop to 22 in 2023 and expire at the end of 2023. The ITC for solar customers was originally scheduled to drop from 26 in 2020 to 22 in 2021 and then be phased out all together in 2022.

The committees are said to support the inclusion of a one-year extension of tax credits for the wind and solar industries at their current level as well as the multiyear extension and expansion of.