LPs can be high net-worth individuals family offices foundations big corporations endowment funds pension funds or funds of funds. Associates have different functions at different VCs.

Fund Structures and Legal Entities Founders of a VC firm are conventionally called General Partners GPs and the investors they target are conventionally called Limited Partners LPs.

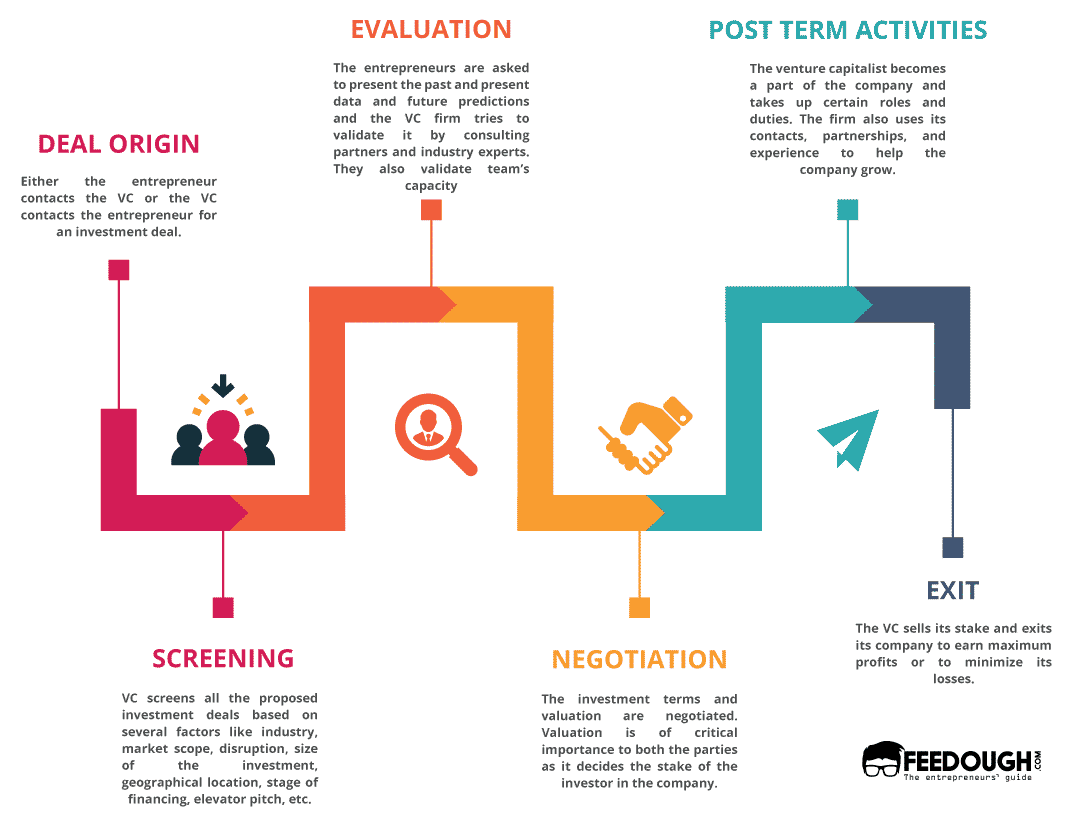

What is a vc firm. Venture capital firms raise capital from Limited Partners such as pension funds endowments and family offices and then invest in early-stage high-growth-potential companies in exchange for equity ie ownership in the companies. A Venture Partner is a person who a VC firm brings on board to help them do investments and manage them but is not a full and permanent member of the partnership. Venture Partner Partner VPs.

Usually there roles are a combination of. They essentially run the firm engage in fundraising and vote on the deals the firm considers executing. You raise the fund you make the calls.

Lawyers dont like the term General Partners and more and more firms. VC Firms are investment firms. Because the investments are risky the venture capital firm typically charges a higher interest rate to the businesses it is investing in than other types of.

Note that some larger firms have smaller committees of MDs GPs that wield most or all of the power. Venture capital firms are investment companies that operate only to handle investments in business ventures that may be considered high risk. Deal support analysis quant legal for deals a partner is seriously considering.

A venture capitalists firm is a group of investors who gain income from wealthy people who want to grow their wealth. One of the most sought-after question. And venture capital firms do not just provide start up financing.

They take this money and use it to invest in more risky businesses than a traditional bank is willing to take on. Investors of VC firms are called Limited Partners LPs. They take this money and use it to invest in more risky businesses than a traditional bank is willing to take on.

Deal sourcing for partners. A venture capital firm is a group of investors who gain income from wealthy people who want to grow their wealth. The full and permanent members of the partnership are often called General Partners Managing Members or Partners.

What Do Venture Capitalists Do. Most firms have associates and partners and some have an additional role called a principal. Because of this one rule controls.

Venture capital generally comes from well-off investors investment banks and any other financial institutions. In most organizations Venture Partners Partners. And LPs not only want to invest in a relatively small group of VC funds in particular they are picking specific GPs at those funds to really back in most cases.

Harder than it looks. LPs are the institutional or individual investors that have invested capital in the funds. This is generally the next step down the ladder but not always.

In simpler terms a firm which invests in startups is called as VC or venture capital. What a Venture Capitalist Is A venture capitalist VC is an investor who supports a young company in the process of expanding or provides the capital needed for a startup venture.