Acting like a physical trading company. In the commodities segment futures trading help in mitigating the price risk.

Top 10 Global Commodity Trading Companies That Move Markets Futures

What are physical commodities.

Physical commodity trading companies. Get the Commodity Value Including Commodity Name Expiry Date LTP Previous Close Value and Change. By managing global trading from a central location a trading company is positioned to sell product into whatever market will fetch the top profit margin. Our pursuit of perfection in global trade makes us leaders in local and international commodities sourcing and procurement applying a customized approach to each trade.

Physical commodities trading companies are the companies that secure a supply of commodities from end-producers and help to market them across the geographical location to a wholesaler or end user. It trades oil and other commodities from Geneva London Singapore Shanghai and Houston. Coal Oil petroleum products Aviation Jet Fuel Bunker Grains Oilseeds Steel Fertlizers Gas Chemicals Metals NGL LPG LNG trading companies directory.

They add value addition to the supply chain through their knowledge in the field of transportation finance and risk hedging. Own warehousing and funding will give some cushion. Above all else we know that our.

Physical commodities are the fundamental raw materials that underpin the global economy. Engages in the sourcing and trading of crude oil petroleum products renewable energies metals metal ores coal and concentrates for industrial consumers worldwide. Privately-held Vitol is the worlds largest physical oil and gas trader.

According to the firm crude oil is the most substantial part of its energy portfolio. They add value to the supply chain through their unique know-how in the field of transportation financing and risk hedging. International commodity trading companies are sophisticated sales and marketing arms set up by many major oil and gas and mining companies that work to sell product to the highest bidder.

Commodity Trading Focus. According to the firm crude oil is the most substantial part of its energy portfolio. Companies in this business deal with huge volumes and low profit margins.

Mercuria is largely a physical trader of energy such as crude oil and its products like fuel oil middle distillates naphtha and gasoline as well as electricity natural gas coal and. International Commodity Traders ICT LLC is a Special Purpose Entity - the parent in a group of companies specifically formed with the intent to engage in the trading of physical commodities in the international market place. Privately-held Vitol is the worlds largest physical oil and gas trader.

Warehousing in itself is not a profitable business unless and until collateral management is linked to it. Physical commodities trading companies Trading houses Physical commodities traders. Physical commodity tradingmerchandising is about moving raw material from the area of production to an area of consumption.

Specialization around few commodities to start with. Import and export of commodities. Even though it is not likely that a counterparty defaults in the unlikely event that one does a trader.

We are a recognised and trusted physical commodities trading company providing valuable source of global business opportunities which enable us to meet the best interests of our clients. I believe it takes 40 days or so depending on how full the pipeline is for oil to flow from Canada down in to PADD 3 Gulf Coast. Mercuria is majorly a physical trader of energy products such as crude oil and its products.

We depend on them for the basics of everyday life for the electricity we use the food we eat the clothes we wear the homes we live in and the transport we rely on. The physical trading of commodities is done between different counterparties and there is a time delay between when the deal is done and when oil is delivered. 91 80122 78000 CUSTOMER SUPPORT.

There is a credit risk during that 40 day delay. Mercurias core business is sourcing supplying and trading crude oil and refined petroleum. Trafigura sources stores blends and transports raw materials including oil refined petroleum products and non-ferrous metals iron ore and coal.

Its product portfolio includes gasoline fuel oil natural gas coal biodiesel distillates naphtha and electricity. Trafigura is the third-largest physical commodities trading group in the world behind Vitol and Glencore. They are traded in vast quantities across the globe.

Commodity Trading Focus. The producers use the future markets to hedge their production while the end-user use to hedge their purchase. Even if the paper side is the one under the light the backbone remains the physical side.

Physical commodities trading companies are the companies that secure a supply of commodities from end-producers and help to market them across the geographies to a wholesaler or end user.

Commodity Trading Backbone Of The Global Economy By Comdex Official Medium

Pin By Interactive Energy On Energy Commodities Trading Trading Company

Pin By Interactive Energy On Energy Commodities Trading Trading Company

What Is Ctrm Definition And Meaning Enhelix

What Is Ctrm Definition And Meaning Enhelix

J P Morgan Commodities Assets Sale To Mercuria Smaller Than Planned Wsj

J P Morgan Commodities Assets Sale To Mercuria Smaller Than Planned Wsj

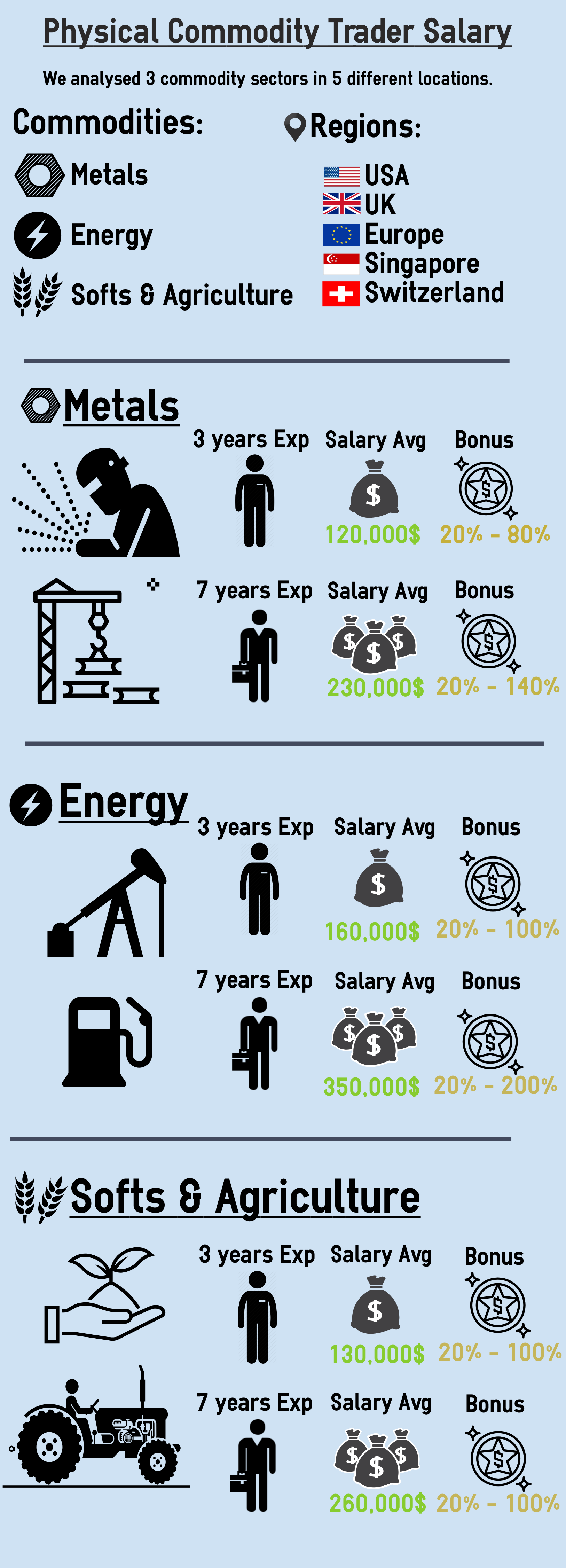

Physical Commodity Trader Salary Shipping And Commodity Academy

Physical Commodity Trader Salary Shipping And Commodity Academy

Trading Companies Archives Shipping And Commodity Academy

Trading Companies Archives Shipping And Commodity Academy

How Commodity Producers Can Raise Their Trading Game Bain Company

How Commodity Producers Can Raise Their Trading Game Bain Company

Physical Commodities Trading Companies Physical Commodities Traders Portal

The Role Of Physical Commodity Trading Companies

The Role Of Physical Commodity Trading Companies

4 Parts Structuring A Commodity Trading Company Shipping And Commodity Academy

4 Parts Structuring A Commodity Trading Company Shipping And Commodity Academy

Commodity Trading Backbone Of The Global Economy By Comdex Official Medium

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.