What is private credit. Delay applying for credit.

How Private Credit Soared To Fuel Private Equity Boom Bloomberg

Hard inquiries cause a dip in your credit score.

What is private credit. Private credit is a specialized asset class that reduces exposure to variable interest rates and allows investors to capitalize on higher yields. Private Credit typically refers to debt instruments which are not financed by banks and are not issued or traded in an open market ie. While some directly originate private loans to borrowers others source exposure indirectly from banks in.

In private credit the investor lends money to the company in exchange for interest payments and can impose covenants. Private credit is the fastest-growing institutional asset class in the world which has greatly evolved since the 2008-09 financial crisis to firmly establish itself. Private credit is direct lending into middle market companies.

Private Credit investing is an essential component of Morgan Stanley Investment Managements alternative investments platform. Within the private debt market investors lend to investee entities be they corporate groups subsidiaries or special purpose vehicles established to finance specific projects or assets in. Private debt falls into a broader category termed alternative debt or alternative credit and is used interchangeably with direct lending private lending and private credit.

Unlike publicly traded debt private credit is typically a customized financing solution to address specific needs of middle market buyouts refinancing or project finance. Additionally private credit deals also tend to employ less leverage and possess more equity which helps contribute to their overall stability. In private equity an investor owns all or part of the company.

Effective recovery depends significantly on how close the investor is to both the loan and the underlying collateral. When you apply for a loan credit card or another type of revolving credit the lender will ask one or more of the credit bureaus for your credit file which causes a hard inquiry on your credit report. Private credit fund sponsors have developed fund structures primarily by re-purposing traditional private equity fund structures such as those used to make leveraged buy-outs real estate and similar illiquid investments.

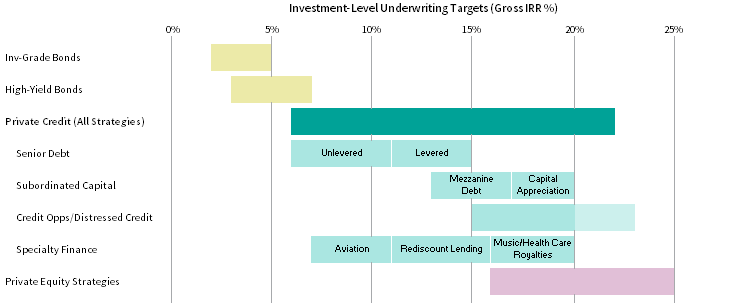

Private credit is an asset class comprised of higher yielding illiquid investment opportunities that covers a range of riskreturn profiles. This includes debt that is secured and senior in the capital structure with fixed income like characteristics and distressed debt that has very equity like risk and returns. However in private credit the lender must be prepared to be much more hands-on in order to maximize a loans recovery.

What is Private Credit. As a result they share certain structural similarities with traditional private equity funds. Private credit covers a broad spectrum from opportunistic and distressed debt to middle market investing and specialty finance.

The downside however is that private debt loans tend to have longer terms which negatively affects investors liquidity. We manage a well-defined group of strategies and seek to deliver attractive returns to our investors by forging successful partnerships with our portfolio companies. Private credit is a way for businesses to raise capital money.

Private credit refers to any loan offered by an entity that is not a bank and it comes in many flavorsfrom peer-to-peer P2P lending platforms like. The borrower can be a public or private company it is the instrument itself which is private. Private credit on the other hand is more fundamentally driven and generally less affected by market technicals because it is typically held in lock-up vehicles that are not actively traded.

Also known as private debt non-bank lending alternative lending or shadow lending private credit can be described as an asset class comprised of higher yielding illiquid investment opportunities ranging from secured debt that is senior in the capital structure with fixed income-like characteristics to distressed debt that displays equity-like risk and returns. Private credit represents part of the broader alternatives universe referring to non-traditional assets relying to some degree on an illiquidity risk premium to help drive excess returns.

An Overview Of Private Debt Technical Guide Pri

Private Credit Strategies An Introduction Insurance Aum Journal

Latest Research Perspectives Cambridge Associates

An Overview Of Private Debt Technical Guide Pri

Private Credit An Alternative Route To Investment Enhancement Blackrock Asian Private Banker

Understanding Public And Private Credit Pimco

Earning An Illiquidity Premium In Private Credit Pimco

Private Credit And The Data Driven Revolution Qbridge Data Science For Finance

The Evolution Of Private Credit Marquette Associates

Private Credit Why Pc Is The New Pe Hedgenordic

Private Credit Demystified The Absolute Return Letter

Latest Research Perspectives Cambridge Associates

Private Credit One Ring To Rule Them All Features Ipe

An Overview Of Private Debt Technical Guide Pri

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.