We determine how much cash clients hold as a percentage of their AUM currently in the 134 range. Loans are eligible for only one Investor.

What Declining Interest Rates Could Mean For You Charles Schwab Commentaries Advisor Perspectives

What Declining Interest Rates Could Mean For You Charles Schwab Commentaries Advisor Perspectives

As is the case.

Schwab margin interest rate. Interest Charged on Margin Loans View Examples. Margin is a feature that may be available on your brokerage account and if it is you can start to borrow with as little as 2000 in eligible securities at competitive interest rates. Margin is a feature that may be available on your brokerage account and if it is you can start to borrow with as little as 2000 in eligible securities at competitive interest rates.

Margin borrowing is generally more cost-effective than consumer lending options like credit cards. As the Fed has raised. In 2015 when the Federal Funds rates averaged less than 025 Schwab generated an average net interest margin of 160.

The applicable margin interest rate is set at a percentage above Schwabs Base Rate according to the following schedule. Such account features could influence customers ratings of their brokers for margin trading along with the interest rate charged. 5 rows Charles Schwab margin loans.

If your brokerage firms maintenance requirement is 30 30 of 6000 1800 you would receive a margin call for 800 in cash or 1143 of fully paid marginable securities 800 divided by 1-30 1143or some combination of the twoto make up the difference between your equity of 1000 and the required equity of 1800. So its critical you dont leverage too much if you use margin. If your daily adjusted debit balance is.

Schwabs margin trading is expensive but Schwab makes up for it. A margin loan is a ready source of credit that may be used for purchasing securities or other needs. The current Federal Funds Rate at the beginning of 2018 is at 150 so margin rates are starting to creep up.

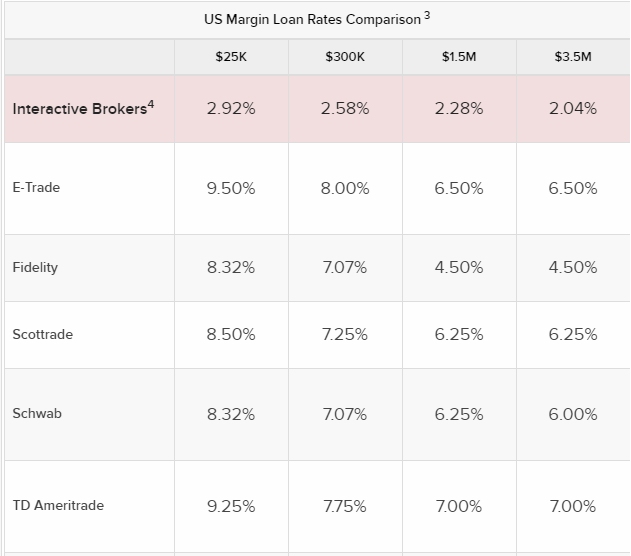

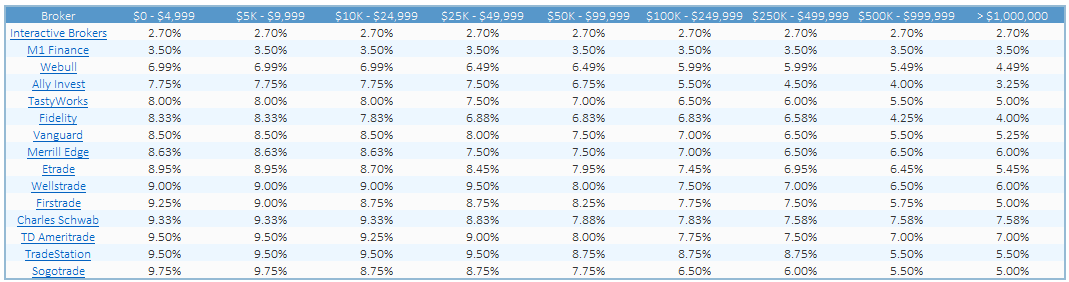

2 Zacks Trades margin rate starts at 356 compared to Charles Schwab rate starting at 8325 ETrade rate starting at 895 Fidelity rate starting at 8325 TD Ameritrade rate starting at 950 and Vanguard rate starting at 850. In most cases you are paying a heavy premium for it. 1 day agoOf last quarters 47 billion top-line 19 billion of it came from interest rate-related sources like margin loans and money market funds despite the challenging environment.

Like any other borrowing product you must repay your margin debit balance along with interest regardless of the underlying value of any positions you might have secured with margin. Zacks Trade commissions for stocks start at 001 per share with a 100 minimum. For example for a balance over USD 1000000 the first 100000 is charged at the Tier I rate the next 900000 at the Tier II rate etc.

Net interest margin the difference between the assets it owns from customer cash balances less what they pay out to customers all of which tells us the profitability of Schwabs assets. A higher effective rate of interest than if a year of 365 days were used. Ready line of credit.

Schwab can change its maintenance margin requirements at any time without prior notice. The applicable margin interest rate is. Charles Schwab and.

You must repay your margin loan regardless of the underlying value of the securities you purchased. Competitive interest rates. Due to Schwabs competitive rates margin borrowing can be more cost-effective than other consumer lending options.

When calculating rates keep in mind that IBKR uses a blended rate based on the tiers below. Margin is a flexible lending solution available to Schwab clients looking to purchase additional securities or meet short-term borrowing needs. 6 rows Charles Schwab margin rates are high and start at 9575 for the most customers.

Compare Mortgage Interest Rates Education Investing. Interest on margin loans may be tax deductible against your net investment. 02499999 Base rate plus 20 250004999999 Base rate plus 15.

Margin is a flexible lending solution available to Schwab clients looking to purchase additional securities or meet short-term borrowing needs. Margin borrowing increases your level of market risk so the value of your investments can go down as well as up. In the table below youll see that most of the brokers make off very well with the interest they charge.

11 rows For Schwab Bank Investor Advantage Pricing IAP.

Margin How Does It Work Charles Schwab

Margin How Does It Work Charles Schwab

Interactive Brokers Interest Rate Play In A Trillion Dollar Market Nasdaq Ibkr Seeking Alpha

Interactive Brokers Interest Rate Play In A Trillion Dollar Market Nasdaq Ibkr Seeking Alpha

Charles Schwab Margin Rates 2021

Charles Schwab Margin Rates 2021

Charles Schwab Margin Rates 2021

Charles Schwab Margin Rates 2021

Investing With Margin Is It Risky Or Genius

Investing With Margin Is It Risky Or Genius

Stock Settlement Why You Need To Understand The T 2 Timeline Charles Schwab

Stock Settlement Why You Need To Understand The T 2 Timeline Charles Schwab

What Are Trading Margin Rates And How Are They Calculated

What Are Trading Margin Rates And How Are They Calculated

Interactive Brokers Offers Low Margin Lending Rates Barron S

Interactive Brokers Offers Low Margin Lending Rates Barron S

Https Www Schwab Com Public File P 4193744

Margin Trading Which Broker Offers You The Best Rate Investor S Business Daily

Margin Trading Which Broker Offers You The Best Rate Investor S Business Daily

Margin Expands Regardless Of Rate Barron S

Margin Expands Regardless Of Rate Barron S

Margin How Does It Work Charles Schwab

Margin How Does It Work Charles Schwab

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.